According to a recently published report from the Centers of Disease Control (CDC), which polled a nationally representative sample of Americans in 2020, “31.6 million (9.7%) people of all ages were uninsured at the time of the interview.” The report analyzed different population and income groups and the coverage trends therein. The authors note that even though healthcare coverage increased overall with the passage of the Affordable Care Act, known more commonly as Obamacare, disparities in insurance coverage, particularly between different racial and ethnic groups, persist.

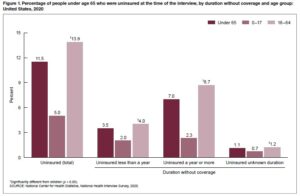

Figure 1: A breakdown of uninsured Americans by age in 2020- Source: Dept. of Health and Human Services

Figure 1: A breakdown of uninsured Americans by age in 2020- Source: Dept. of Health and Human Services

Market segmentation is one of the biggest challenges when Payers attempt to build and maintain their client base. Whether Payers try to revise and market their provider networks to existing clients between coverage years or if they’re trying to draw in new customers. Therefore, a good market data analysis is indispensable for Payers looking to increase their market share.

Payers already collect data on their established clients, but what about those people mentioned above, those who aren’t insured? So how does an insurance company glean insight into that market segment? That’s where AI comes in.

AI Analytics and Payers

One of the critical features of the C3S platform is its sophisticated population analytics function, which allows users to centralize data collection and then analyze said data. It begins with the intake process, in which clients submit information about their demographics, income level, and living situation to C3S’s HIPAA-compliant platform. Users can then draw upon the data presented in the intake process to run reports about different client demographics, income levels, and service histories.

Payers can use this function to analyze a potential client base. Such analysis would yield insight into trends among demographic breakdowns in particular geographic areas, including services that tend to get used. For example, if clients from a specific zip code frequently travel outside of that zip code to get benefits, this may indicate to an insurance company that they need to expand their networks into those areas. This would allow companies to expand their clientele while enabling underserved communities to get services without traveling. It’s a win-win: the client has easier care access, and the company increases its reputation for convenience.

Moreover, demographic analysis from a potential base can be compared to national and local averages. For example, a broad difference in coverage between different income groups may mean the company needs to step up its marketing efforts in a particular locale or even offer leaner, more affordable plans that people in those communities are more likely to purchase.

From there, an insurance company can begin to craft a marketing plan to try and recruit new customers. What’s more, C3S’s communications tools allow companies to stay in touch with their existing clients by sending appointment reminders and messages with preventative care tips. In addition, it provides streamlined coordinated care for healthcare and service providers in the same network but employed in different institutions.

In short, Payers looking to improve their market share need access to good data. C3S provides an invaluable service for Payers trying to develop a new marketing plan and provide more convenient care for their existing clients. Learn more today.

Recent Comments